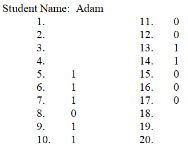

Given the data below, answer the following questions:

-Why are items 18-20 not scored?

Definitions:

Government Purchases

Expenditures by the government for goods and services that directly satisfy public consumption or are invested in public infrastructure.

Taxes

Taxes are compulsory financial charges or some other type of levy imposed upon a taxpayer by a governmental organization in order to fund government spending and various public expenditures.

Fiscal Policy

Government adjustments in spending levels and tax rates to monitor and influence a nation's economy.

Interest Rates

The percentage charged by lenders for borrowing money or paid by banks to depositors, influencing economic activity.

Q3: Comparing the scores of a new assessment

Q5: Somimad Sawmill manufactures two lumber products from

Q9: The percentile ranking of a student on

Q10: Dee is actively listening to John's presentation.

Q12: Continuing Ultimate U-bolts above. Which is true?<br>A)The

Q16: Describe the specific components of an IFSP.

Q21: Grammy Girl Products (GGP) has two

Q25: A person with an obtained IQ score

Q30: Portfolio assessment is a method of comparing

Q91: Jim is in China teaching English as