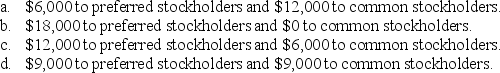

The Surf's Up issues 1,000 shares of 6%,$100 par value preferred stock at the beginning of 2014.All remaining shares are common stock.The company was not able to pay dividends in 2014,but plans to pay dividends of $18,000 in 2015.Assuming the preferred stock is noncumulative,how much of the $18,000 dividend will be paid to preferred stockholders and how much will be paid to common stockholders in 2015?

Definitions:

Margin Deposits

Funds that an investor must deposit as collateral to borrow from a broker to buy securities, typically used for trading on margin.

Call Options

Financial derivatives that grant the holder the option to purchase stocks or other assets at a predetermined price before the option expires.

Put Options

A financial contract granting the owner the right, but not the obligation, to sell a specified amount of an underlying asset at a set price within a specified timeframe.

Break-Even Price

The market price that an asset must reach for an investor to recover their initial investment without making a profit or loss.

Q40: For bonds issued at a premium,the difference

Q50: When bonds are issued at a premium

Q51: Describe the primary advantages and disadvantages of

Q54: Using the indirect method,we begin with net

Q65: Companies are free to choose FIFO,LIFO,or weighted-average

Q65: We report extraordinary items separately,net of taxes,near

Q73: Explain why we record interest in the

Q84: How does the stockholders' equity section in

Q119: The ending Retained Earnings balance of Lambert

Q123: On May 15,Canadian Falcon declares a quarterly