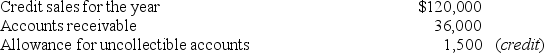

A company reports the following amounts at the end of the year (before any year-end adjustment).

Record the adjustment for uncollectible accounts (1)using the percentage-of-receivables method,assuming the company estimates 10% of receivables will not be collected,and (2)using the percentage-of-credit-sales method,assuming the company estimates 2% of credit sales will not be collected.

Record the adjustment for uncollectible accounts (1)using the percentage-of-receivables method,assuming the company estimates 10% of receivables will not be collected,and (2)using the percentage-of-credit-sales method,assuming the company estimates 2% of credit sales will not be collected.

Definitions:

Investment Project

A project undertaken by a company involving significant capital expenditure with the expectation of generating future profits.

Profitability Index

A calculation used to determine the relative profitability of an investment, based on the present value of future cash flows divided by the initial investment cost.

Internal Rate

Often refers to internal rate of return (IRR), a financial metric used to estimate the profitability of potential investments.

Cash Inflows

The money received by a business from its various sources during a specific period, such as sales revenue, investments, and financing.

Q7: _ Assets created before the expense is

Q19: For most companies,actual physical flow of their

Q63: What is meant by the assertion that

Q75: The Sarbanes-Oxley Act is also known as

Q85: The following data were obtained from the

Q86: Which of the following intangible assets is

Q106: If management can estimate the amount of

Q119: Which of the following accounts will NOT

Q156: On October 22,a company provides services on

Q165: When the balance of the Unearned Revenue