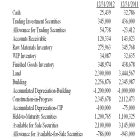

A partial balance sheet for BCS,Inc.for December 31,2012 and December 31,2011 is provided below.You are working on the audit for the 12/31/12 year-end.The 12/31/11 balance sheet numbers were audited by your CPA firm last year.Use the partial balance sheet for BCS provided below.You have been assigned to audit the land,building,and equipment accounts.  a.During the year the company purchased land for $1,000,000.What was the cost of land sold during the year?

a.During the year the company purchased land for $1,000,000.What was the cost of land sold during the year?

b.Can you determine if the land was sold for a gain or a loss? How would you calculate the gain or loss on sale?

c.During the year,the company sold one building and did not purchase any additional buildings.The building sold for $200,000.$60,000 of depreciation had been taken on the building up to the point of the sale.What was the amount of the gain or loss on the sale?

d.If buildings are depreciated over 25 years on a straight-line basis,is the amount of depreciation expense taken in 2012 on the buildings reasonable? Show your calculations to support your answer.e.What audit procedures would you perform to determine that the $1,000,000 assigned to the purchase of the land was correct?

f.What is the GAAP rule for recording fixed asset purchases?

g.What is the GAAP rule for valuing fixed assets at year-end?

Definitions:

Circular Pitch

In gear design, the distance measured along the pitch circle between corresponding points on adjacent teeth.

Root Diameter

The diameter of a gear or screw measured at the base of the teeth or threads, where the material is the thickest.

Bevel Gears

Gears with intersecting shafts and conically shaped teeth that are used to change the axis of rotation in machinery.

Intersecting Axes

The point or line where two or more axes meet or cross each other.

Q4: You are responsible for planning the audit

Q12: In the request for information from the

Q15: The discipline that studies planned changes or

Q17: Which of the following statements best describes

Q20: Sampling methods for substantive samples include<br>A)skip random

Q54: The auditor has to develop an audit

Q60: Which of the following is correct about

Q62: The action research model does not call

Q69: If the auditor selects the sample of

Q72: Assume that you have been assigned to