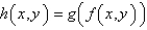

Find  , if

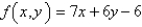

, if  and

and  .

.

Definitions:

Qualified Moving Expenses

Qualified Moving Expenses are those costs that are deductible when an individual relocates for employment reasons and meets certain distance and time tests defined by the IRS.

Temporary Storage Costs

Expenses incurred for storing personal property for a short period, possibly deductible under certain tax situations.

Modified AGI

An adjustment to adjusted gross income, including or excluding certain items, used to calculate eligibility for specific tax benefits.

Education Loan Interest

The interest paid on a loan taken out to pay for educational expenses, which may be deductible on your taxes under certain conditions.

Q7: Determine whether the series is convergent or

Q30: Test the series for convergence or divergence.

Q35: The Pacific halibut fishery has been modeled

Q41: The joint density function for random variables

Q43: Use the Midpoint Rule for double integrals

Q46: Use the given transformation to evaluate the

Q81: A projectile is fired from a height

Q96: Find equations for the tangent plane and

Q130: Given the series <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5971/.jpg" alt="Given the

Q151: Determine whether the series converges or diverges.