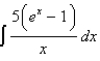

Evaluate the indefinite integral as an infinite series.

Definitions:

Marginal Tax Rates

The tax rate applied to the last unit of income earned, indicating the percentage of additional income that is paid in taxes.

Federal Personal Income Tax

A tax levied by the federal government on the annual income of individuals, with the tax rates varying based on income levels.

Taxable Corporate Income

The portion of a corporation's income that is subject to taxation according to federal and state laws.

Basic Tax Rate

The standard rate at which an individual or corporation is taxed, before any adjustments, deductions, or exemptions are applied.

Q12: Reparametrize the curve with respect to arc

Q13: Write inequalities to describe the solid upper

Q22: Calculate the given quantities if <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5971/.jpg"

Q53: A trough has vertical ends that are

Q57: Write an inequality to describe the half-space

Q61: Find the radius of convergence and the

Q62: Use cylindrical coordinates to evaluate the triple

Q109: Evaluate the limit. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5971/.jpg" alt="Evaluate the

Q119: Identify the surface with equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5971/.jpg"

Q119: Determine whether the improper integral converges or