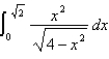

Evaluate the integral using an appropriate trigonometric substitution.

Definitions:

Federal Marginal Income Tax

pertains to the portion of tax applied to an individual's or entity's last dollar of income, under the federal tax system, which uses progressively higher rates for higher income levels.

Tax Bracket

Categories at varying tax rates applied to ranges of income; the higher the income, the higher the percentage of tax levied.

Progressive

Pertains to political and social movements that aim for reforms and advancements by advocating for changes in economic, social, and political structures.

Taxable Income

The portion of an individual's or a company's income used to determine how much tax they owe to the government in a given tax year.

Q4: A function <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5971/.jpg" alt="A function

Q23: Solve the differential equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5971/.jpg" alt="Solve

Q26: Use the method of disks or washers,

Q34: The region <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5971/.jpg" alt="The region

Q51: Write the expression as an exponent with

Q65: Find an equation of the tangent to

Q74: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5971/.jpg" alt="If of

Q77: Find the general indefinite integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5971/.jpg"

Q94: Find <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5971/.jpg" alt="Find

Q129: Find the limit if <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5971/.jpg" alt="Find