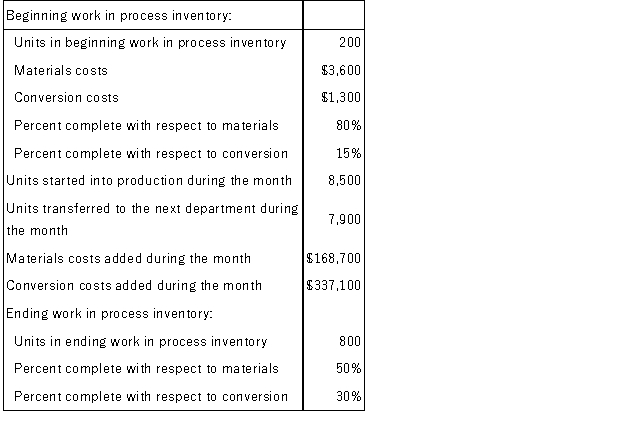

Pushkin Corporation uses the FIFO method in its process costing system.Data concerning the first processing department for the most recent month are listed below:  Note: Your answers may differ from those offered below due to rounding error.In all cases,select the answer that is the closest to the answer you computed.To reduce rounding error,carry out all computations to at least three decimal places. The total cost transferred from the first processing department to the next processing department during the month is closest to:

Note: Your answers may differ from those offered below due to rounding error.In all cases,select the answer that is the closest to the answer you computed.To reduce rounding error,carry out all computations to at least three decimal places. The total cost transferred from the first processing department to the next processing department during the month is closest to:

Definitions:

Collection Float

The time difference between when a check is deposited into a bank account and when the funds are made available.

Availability Delay

The lag time between when a deposit is made into an account and when the funds become available for use.

Collection Float

The time difference between when a check is deposited into a bank account and when the amount is credited to the account, affecting the cash flow.

Collection Float

The time period between when a check is deposited into a bank account and when the amount is available for use.

Q34: The following data relate to the Blending

Q42: Use the graph to determine where the

Q51: Find the linearization L (x) of the

Q74: Garson Corporation uses the FIFO method in

Q78: Easy Inc.uses the FIFO method in its

Q100: Excerpts from Deblois Corporation's comparative balance sheet

Q113: If a rock is thrown upward on

Q124: A television camera is positioned 4,600 ft

Q131: Belk Corporation's balance sheet appears below: <img

Q154: Data from Dunshee Corporation's most recent balance