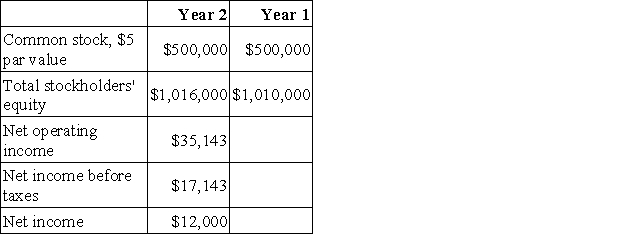

Leflore Corporation has provided the following data:  Dividends on common stock during Year 2 totaled $6,000.The market price of common stock at the end of Year 2 was $1.38 per share.The company's dividend yield ratio for Year 2 is closest to:

Dividends on common stock during Year 2 totaled $6,000.The market price of common stock at the end of Year 2 was $1.38 per share.The company's dividend yield ratio for Year 2 is closest to:

Definitions:

Direct Method

A method for preparing the cash flow statement that lists major classes of gross cash receipts and payments.

Income Tax Expense

The cost associated with the taxes on a company's taxable income, reflecting the amount of income tax a company expects to pay to the government.

Income Taxes Payable

The sum of income tax that a corporation is liable to pay to the government but has not paid so far.

Cash Payments

Transactions involving the transfer of cash from one entity to another as a form of compensation or settlement.

Q13: In computing the cost per equivalent unit,costs

Q34: Find <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5971/.jpg" alt="Find

Q68: Higgins Labs Inc. ,uses a process costing

Q83: Hirshberg Corporation's comparative balance sheet appears below:

Q85: The management of Moya Corporation is investigating

Q86: Mayfield Corporation has provided the following financial

Q91: Data from Yochem Corporation's most recent balance

Q110: The accounts receivable for Note Corporation was

Q197: Shipley Corporation has provided the following data

Q211: Laverde Corporation has provided the following data: