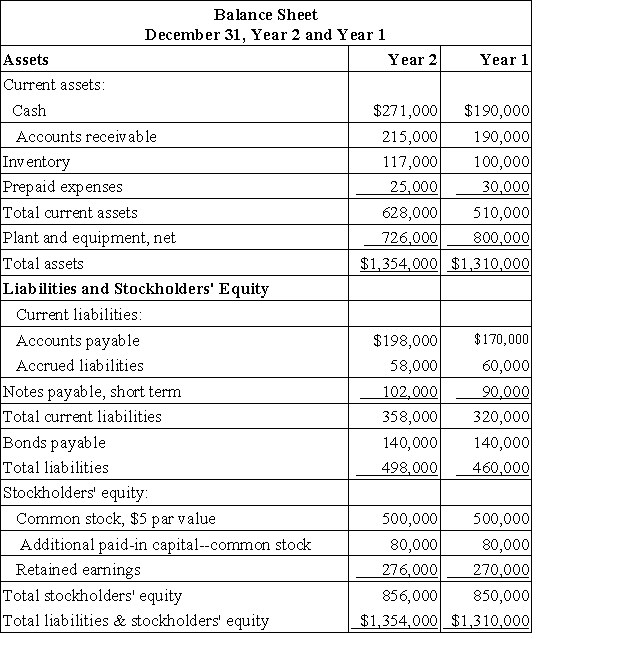

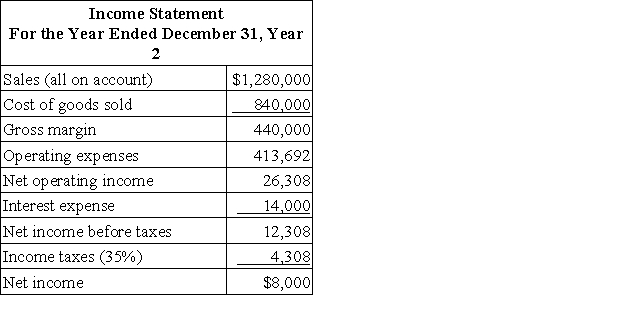

Medina Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $2,000.The market price of common stock at the end of Year 2 was $1.49 per share.

Dividends on common stock during Year 2 totaled $2,000.The market price of common stock at the end of Year 2 was $1.49 per share.

Required:

a.What is the company's times interest earned for Year 2?

b.What is the company's debt-to-equity ratio at the end of Year 2?

c.What is the company's equity multiplier at the end of Year 2?

d.What is the company's net profit margin percentage for Year 2?

e.What is the company's gross margin percentage for Year 2?

f.What is the company's return on total assets for Year 2?

g.What is the company's return on equity for Year 2?

h.What is the company's earnings per share for Year 2?

i.What is the company's price-earnings ratio for Year 2?

j.What is the company's dividend payout ratio for Year 2?

k.What is the company's dividend yield ratio for Year 2?

l.What is the company's book value per share at the end of Year 2?

Definitions:

Payment Of Dividends

The distribution of a portion of a company's earnings to its shareholders, usually in the form of cash or additional shares.

Interest Expense

The expense that an entity has to bear for the money it borrows over a certain duration.

Preferred Stock

A type of stock that offers dividends at a fixed rate and has priority over common stock in the distribution of assets during a company's liquidation.

Statement Of Cash Flows

A report detailing the movements in cash and cash equivalents due to variations in the balance sheet positions and income, segmented by operations, investments, and financing actions.

Q25: The amount of depreciation added to net

Q37: When used in return on investment (ROI)calculations,operating

Q46: Excerpts from Neuwirth Corporation's comparative balance sheet

Q77: The data given below are from the

Q78: Find the interval(s) where <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5971/.jpg" alt="Find

Q79: The following information was obtained from the

Q92: One criticism of the payback method is

Q104: Salsedo Corporation's balance sheet and income statement

Q268: Harris Corporation,a retailer,had cost of goods sold

Q328: The following standards for variable manufacturing overhead