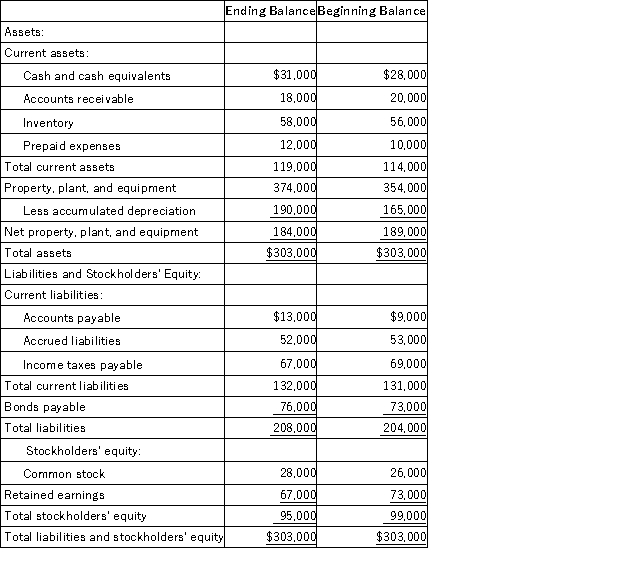

Krech Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000.It did not sell or retire any property,plant,and equipment during the year.The company uses the indirect method to determine the net cash provided by operating activities. Which of the following is correct regarding the operating activities section of the statement of cash flows?

The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000.It did not sell or retire any property,plant,and equipment during the year.The company uses the indirect method to determine the net cash provided by operating activities. Which of the following is correct regarding the operating activities section of the statement of cash flows?

Definitions:

Purchase Price

The amount of money paid to buy goods or services.

Merchandise Inventory

Goods or products that a retailer or wholesaler has purchased and intends to sell to customers.

Periodic System

An inventory system where inventory levels are updated in the accounting records on a periodic basis, typically at the end of an accounting period, rather than after each purchase or sale.

LIFO Method

The "Last In, First Out" inventory valuation method, where the most recently produced items are recorded as sold first.

Q2: The Fischer Corporation uses a standard costing

Q6: Abdool Corporation has provided the following financial

Q24: Use the vertical line test to determine

Q80: Wittels Corporation has provided the following data:

Q91: All profit centers are responsibility centers,but not

Q129: Gilson Corporation manufactures and sells a single

Q225: The revenue and spending variances are the

Q250: The standard cost card for one unit

Q254: Burdick Corporation has provided the following financial

Q267: Sperle Corporation has provided the following data