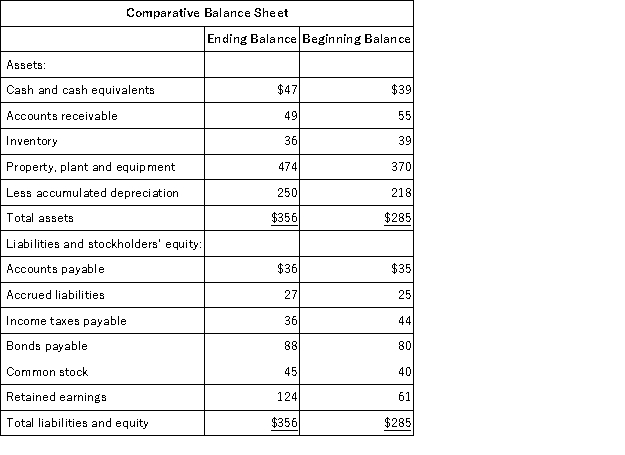

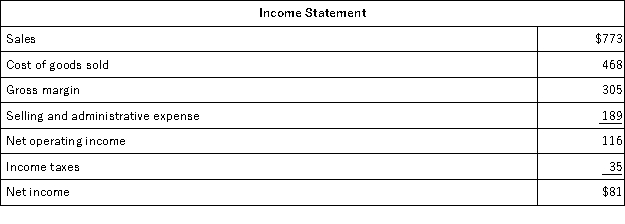

The most recent balance sheet and income statement of Penaloza Corporation appear below:

The company paid a cash dividend of $18.It did not dispose of any property,plant,and equipment.The company did not retire any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows. The net cash provided by (used in) investing activities for the year was:

The company paid a cash dividend of $18.It did not dispose of any property,plant,and equipment.The company did not retire any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows. The net cash provided by (used in) investing activities for the year was:

Definitions:

Debt-equity Ratio

An indicator of a business's debt leverage, computed by dividing the sum of its liabilities by the equity owned by its stockholders.

Financial Planning

The process of estimating the capital required and determining its competition; it is the process of framing financial policies in relation to procurement, investment and administration of funds of an enterprise.

Fixed Percentage

A predetermined, unchanging fraction or rate used in various financial contexts, such as a fixed-rate mortgage.

External Financing

Funds a company seeks from outside sources, such as loans, investor equity, or bonds, to finance its activities.

Q2: Dratif Corporation's working capital is $33,000 and

Q25: The amount of depreciation added to net

Q50: Financial statements of Rukavina Corporation follow: <img

Q71: Last year the Uptown Division of Gorcen

Q76: The project profitability index is computed by

Q78: Easy Inc.uses the FIFO method in its

Q85: If the acid-test ratio is less than

Q222: Kearin Corporation has provided the following financial

Q226: Freiman Corporation's most recent balance sheet and

Q269: Kovack Corporation's net operating income in Year