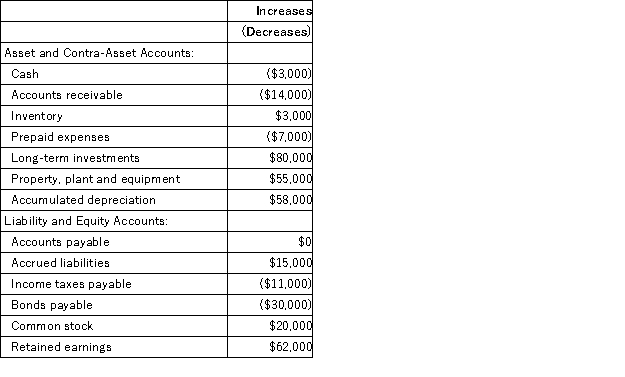

Megan Corporation's net income last year was $98,000.Changes in the company's balance sheet accounts for the year appear below:  The company paid a cash dividend of $36,000 and it did not dispose of any long-term investments or property,plant,and equipment.The company did not issue any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows. The net cash provided by (used in) operating activities last year was:

The company paid a cash dividend of $36,000 and it did not dispose of any long-term investments or property,plant,and equipment.The company did not issue any bonds payable or repurchase any of its own common stock.The following questions pertain to the company's statement of cash flows. The net cash provided by (used in) operating activities last year was:

Definitions:

Flexor Carpi Radialis

A muscle of the forearm that acts to flex and abduct the hand.

Extensor Carpi Radialis Brevis

A muscle in the forearm that assists in extending and abducting the wrist.

Extensor Carpi Radialis Longus

A muscle in the forearm that extends and abducts the wrist, playing a key role in hand movements.

Sartorius

The longest muscle in the human body, running from the hip to the knee, involved in flexing, abducting, and rotating the hip.

Q2: The Fischer Corporation uses a standard costing

Q10: The following information was obtained from the

Q20: Ricric Corporation has provided the following data

Q36: Ribaudo Corporation has provided the following financial

Q60: Pro-Mate,Inc.is a producer of athletic equipment.The company

Q63: Aguilera Industries is a division of a

Q72: Mahoe Corporation has provided the following financial

Q120: In a statement of cash flows,issuing bonds

Q170: Diemert Corporation bases its budgets on machine-hours.The

Q217: Moselle Corporation has provided the following financial