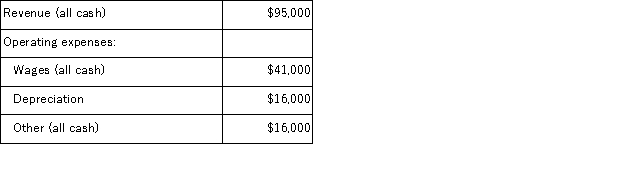

The Halsey Corporation is contemplating the purchase of new equipment that would require an initial investment of $125,000.The equipment would have a useful life of six years,with a salvage value of $29,000.This new equipment would be depreciated over its useful life by the straight-line method.It would replace existing equipment which is fully depreciated.The existing equipment has a salvage value now of $38,000.The anticipated annual revenues and expenses associated with the new equipment are:  Assume cash flows occur uniformly throughout a year except for the initial investment and the salvage value at the end of the project. For this investment,the simple rate of return to the nearest tenth of a percent is:

Assume cash flows occur uniformly throughout a year except for the initial investment and the salvage value at the end of the project. For this investment,the simple rate of return to the nearest tenth of a percent is:

Definitions:

Negative Nominations

A term not typically found in general knowledge domains, lacking a universally recognized definition.

Rejected

Refused acceptance or admission.

Play Groups

Groups organized for children to engage in play and social activities together, often aiming to develop social skills.

Middle Childhood

A developmental stage generally spanning the ages of 6-12 years, characterized by significant cognitive, emotional, and social growth.

Q9: Baldock Inc.is considering the acquisition of a

Q27: The Jenkins Division recorded operating data as

Q58: Naomi Corporation has a capital budgeting project

Q64: Bowen Corporation is considering several investment proposals,as

Q65: Dunay Corporation is considering investing $510,000 in

Q224: Sperle Corporation has provided the following data

Q266: Lasch Corporation has provided the following financial

Q281: As the inventory turnover increases,the average sales

Q293: Eliezrie Corporation makes a product with the

Q396: Smithj Kennel uses tenant-days as its measure