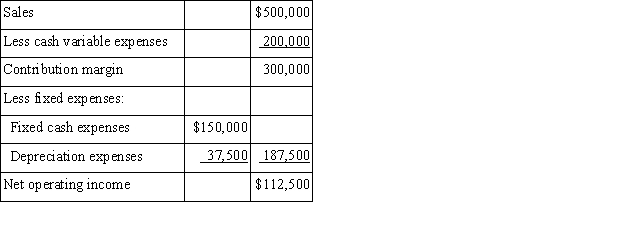

Harrison Corporation is studying a project that would have an eight-year life and would require a $300,000 investment in equipment which has no salvage value.The project would provide net operating income each year as follows for the life of the project:  The company's required rate of return is 10%.The payback period for this project is closest to:

The company's required rate of return is 10%.The payback period for this project is closest to:

Definitions:

Risky Undertaking

An action or venture involving a high degree of uncertainty and potential for loss or failure.

Net Profit

The amount of money that remains from revenues after all expenses, taxes, and costs have been subtracted.

Expected Returns

The mean of all the likely returns for an investment or portfolio over a given period, accounting for the risk of those returns.

Portfolio

An assortment of financial assets such as equities, bonds, commodities, money, and near-money assets, encompassing both closed-end funds and exchange-traded funds (ETFs).

Q34: Under the indirect method of determining the

Q41: Cutsinger Corporation has provided the following data

Q60: Wait time is considered non-value-added time.

Q80: Carlson Manufacturing has some equipment that needs

Q87: Baad Industries is a division of a

Q138: Lasch Corporation has provided the following financial

Q174: Labombard Clinic uses client-visits as its measure

Q197: Shipley Corporation has provided the following data

Q263: All other things the same,those who hold

Q357: Vanderhyde Kennel uses tenant-days as its measure