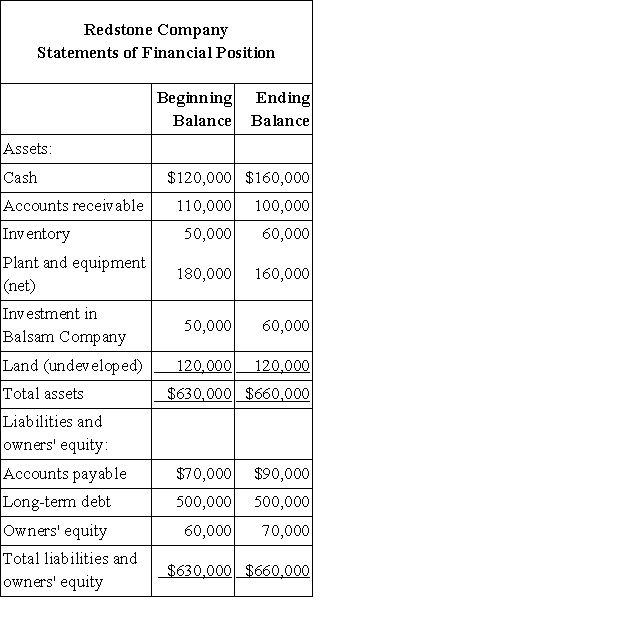

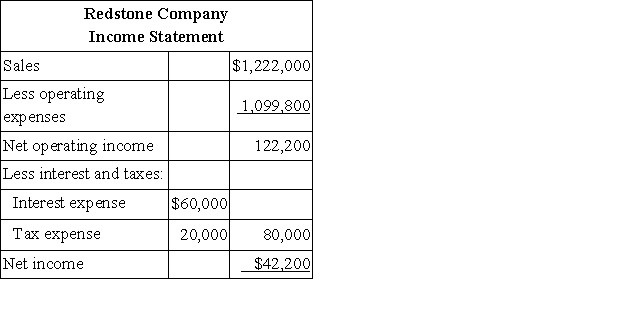

Financial data for Redstone Company for last year appear below:

The company paid dividends of $32,200 last year.The "Investment in Balsam Company" on the statement of financial position represents an investment in the stock of another company.

The company paid dividends of $32,200 last year.The "Investment in Balsam Company" on the statement of financial position represents an investment in the stock of another company.

Required:

a.Compute the company's margin,turnover,and return on investment for last year.

b.The Board of Directors of Redstone has set a minimum required return of 25%.What was the company's residual income last year?

Definitions:

Generally Accepted Accounting Principles

A set of accounting standards and practices that are used to prepare financial statements in the United States, ensuring consistency and comparability across businesses.

Net Realizable Value

The estimated selling price of goods minus the costs of their completion and disposal, used in determining the value of inventory on a balance sheet.

Face Amount

The nominal or principal amount of a bond or other financial instrument, to be repaid at maturity.

Aging

The process of categorizing accounts receivable or inventory based on the length of time they have been outstanding or in stock, often used to identify potential issues.

Q48: Beakins Corporation produces a single product.The standard

Q64: Steinkraus Corporation has provided the following data:

Q68: Birchett Corporation's most recent balance sheet appears

Q69: The Maxwell Corporation has a standard costing

Q76: The project profitability index is computed by

Q169: The sales budget often includes a schedule

Q177: The following data have been provided by

Q202: Oddo Corporation makes a product with the

Q231: Sizzle Company uses a standard cost system

Q309: Gilder Corporation makes a product with the