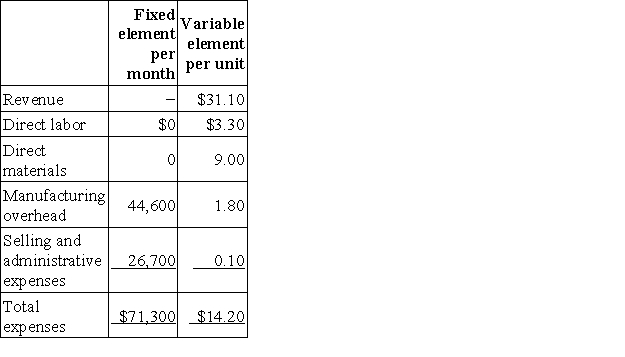

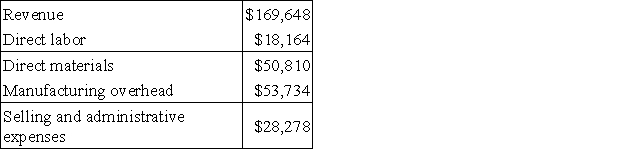

Prater Corporation manufactures and sells a single product.The company uses units as the measure of activity in its budgets and performance reports.During February,the company budgeted for 5,400 units,but its actual level of activity was 5,380 units.The company has provided the following data concerning the formulas used in its budgeting and its actual results for February: Data used in budgeting:  Actual results for February:

Actual results for February:  The manufacturing overhead in the flexible budget for February would be closest to:

The manufacturing overhead in the flexible budget for February would be closest to:

Definitions:

Perpetual Inventory System

This accounting practice immediately logs the sale or acquisition of inventory via computerized point-of-sale systems and software for managing enterprise assets.

Accounts Payable

Short-term debts or obligations a company owes to its suppliers or creditors for goods and services received.

Sales Returns and Allowances

Deductions from a company's sales revenue that account for returned goods and discounts or allowances given to customers.

Purchase Discounts

Reductions in the purchase price of goods, services, or assets, usually offered as an incentive for prompt payment.

Q62: Consider the following three conditions: I.An increase

Q72: Daab Products is a division of a

Q98: The most recent comparative balance sheet of

Q101: (Ignore income taxes in this problem)The management

Q117: Pribyl Corporation has provided the following financial

Q133: Which one of the following transactions should

Q161: A planning budget is prepared before the

Q217: Bronfenbrenner Co.uses a standard cost system for

Q306: Hairston Corporation manufactures and sells a single

Q402: Novelli Corporation makes a product whose variable