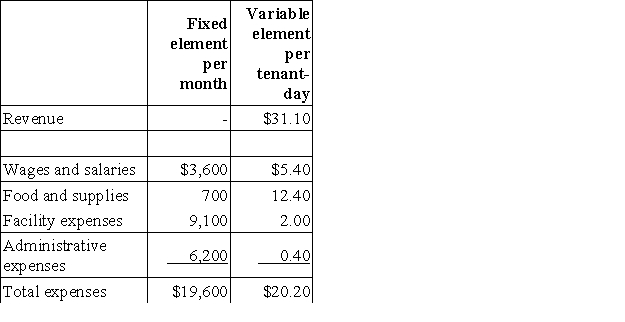

Leaphart Kennel uses tenant-days as its measure of activity;an animal housed in the kennel for one day is counted as one tenant-day.During May,the kennel budgeted for 2,800 tenant-days,but its actual level of activity was 2,840 tenant-days.The kennel has provided the following data concerning the formulas to be used in its budgeting:  The wages and salaries in the planning budget for May would be closest to:

The wages and salaries in the planning budget for May would be closest to:

Definitions:

Joint Venture

An agreement between two or more entities to combine their assets to achieve a particular goal.

Gross Profit

The financial gain derived from subtracting the cost of goods sold from total revenue.

Income Tax Allocation

Income tax allocation involves assigning income tax expense or benefit to the various components of comprehensive income, such as operating income and items recorded directly to equity.

Etiology Model

A theoretical framework used to understand the causes or origins of diseases and conditions, incorporating genetic, environmental, and psychological factors.

Q6: Krech Corporation's comparative balance sheet appears below:

Q15: In preference decision situations,a project with a

Q20: Kaze Corporation's cash and cash equivalents consist

Q73: The following information relates to last year's

Q82: Under variable costing,which of the following is

Q86: Shocker Corporation's sales budget shows quarterly sales

Q93: Alcoser Corporation's most recent balance sheet appears

Q132: The following transactions occurred last year at

Q155: Both variable and fixed manufacturing overhead costs

Q198: Net operating income is affected by the