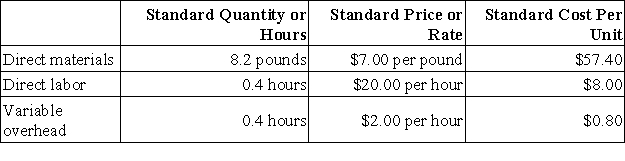

Galla Corporation makes a product with the following standard costs:  The company budgeted for production of 2,400 units in June,but actual production was 2,500 units.The company used 19,850 pounds of direct material and 980 direct labor-hours to produce this output.The company purchased 21,700 pounds of the direct material at $6.70 per pound.The actual direct labor rate was $19.20 per hour and the actual variable overhead rate was $1.80 per hour. The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased.

The company budgeted for production of 2,400 units in June,but actual production was 2,500 units.The company used 19,850 pounds of direct material and 980 direct labor-hours to produce this output.The company purchased 21,700 pounds of the direct material at $6.70 per pound.The actual direct labor rate was $19.20 per hour and the actual variable overhead rate was $1.80 per hour. The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased.

The variable overhead efficiency variance for June is:

Definitions:

Physical Count

The process of manually counting and verifying the quantities of inventory on hand at a specific point in time.

Unearned Rent

Income received for rent before the rental period has occurred, classified as a liability until the period passes.

Adjusting Entry

An accounting record entry made at the conclusion of an accounting period to assign income and expenses to the period they genuinely happened.

Revenue Account

An account that tracks the income earned from normal business operations, including sales of goods or services.

Q8: All of Porter Corporation's sales are on

Q31: Halm Urban Diner is a charity supported

Q33: Cashan Corporation makes and sells a product

Q69: The Maxwell Corporation has a standard costing

Q74: A manufacturing cycle efficiency (MCE)ratio close to

Q110: The Halsey Corporation is contemplating the purchase

Q112: Pearle Corporation makes automotive engines.For the most

Q147: Cervetti Corporation has two major business segments-East

Q195: Bobe Air uses two measures of activity,flights

Q223: The following labor standards have been established