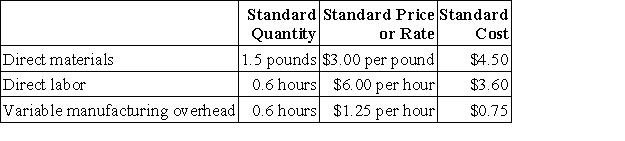

Pardoe Inc. ,manufactures a single product in which variable manufacturing overhead is assigned on the basis of standard direct labor-hours.The company uses a standard cost system and has established the following standards for one unit of product:  During March,the following activity was recorded by the company: • The company produced 3,000 units during the month.

During March,the following activity was recorded by the company: • The company produced 3,000 units during the month.

• A total of 8,000 pounds of material were purchased at a cost of $23,000.

• There was no beginning inventory of materials on hand to start the month;at the end of the month,2,000 pounds of material remained in the warehouse.

• During March,1,600 direct labor-hours were worked at a rate of $6.50 per hour.

• Variable manufacturing overhead costs during March totaled $1,800.

The direct materials purchases variance is computed when the materials are purchased.

The labor efficiency variance for March is:

Definitions:

FIFO Retail Inventory Method

An inventory valuation method which assumes that items purchased or produced first are sold first, thereby computing inventory based on the most recent prices.

Ending Inventory

The value of goods available for sale at the end of an accounting period, calculated as beginning inventory plus purchases minus cost of goods sold.

Net Markups

The amount added to the cost price of goods to cover overhead and profit, minus any discounts or allowances.

Retail Inventory Method

A method used in accounting to estimate the value of a store's merchandise based on the retail price of the inventory.

Q5: Criblez Corporation has two divisions: Blue Division

Q12: Under absorption costing,product costs include: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2461/.jpg"

Q32: The Sawyer Corporation has $80,000 to invest

Q36: The Gerald Corporation makes and sells a

Q38: Rehmer Corporation is working on its direct

Q56: A cost center is not a responsibility

Q86: Schweinert Corporation manufactures a single product.The following

Q113: Sparks Corporation has a cash balance of

Q137: Insider Corporation has two divisions,J and K.During

Q359: Tout Corporation makes a product that has