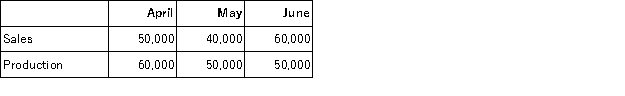

Clay Corporation has projected sales and production in units for the second quarter of the coming year as follows:  Cash-related production costs are budgeted at $5 per unit produced.Of these production costs,40% are paid in the month in which they are incurred and the balance in the following month.Selling and administrative expenses will amount to $100,000 per month.The accounts payable balance on March 31 totals $190,000,which will be paid in April.

Cash-related production costs are budgeted at $5 per unit produced.Of these production costs,40% are paid in the month in which they are incurred and the balance in the following month.Selling and administrative expenses will amount to $100,000 per month.The accounts payable balance on March 31 totals $190,000,which will be paid in April.

All units are sold on account for $14 each.Cash collections from sales are budgeted at 60% in the month of sale,30% in the month following the month of sale,and the remaining 10% in the second month following the month of sale.Accounts receivable on April 1 totaled $500,000 ($90,000 from February's sales and $410,000 from March's sales).

Required:

a.Prepare a schedule for each month showing budgeted cash disbursements for Clay Corporation.

b.Prepare a schedule for each month showing budgeted cash receipts for Clay Corporation.

Definitions:

Total Cost

The total amount of money spent on producing goods or services, encompassing both constant and fluctuating expenses.

ATC

Average Total Cost, which is the total cost of production divided by the number of units produced, encompassing both fixed and variable costs.

TC/q

Total cost divided by quantity; a formula to calculate the average total cost.

Average Total Cost

The sum of all production expenses divided by the quantity of products made, indicating the per-unit cost.

Q35: Dodd Corporation uses the weighted-average method in

Q68: Only variable manufacturing overhead costs are included

Q82: The Assembly Department started the month with

Q105: Kosco Corporation produces a single product.The company's

Q130: Carter Lumber sells lumber and general building

Q156: Self-imposed budgets prepared by lower-level managers should

Q180: Fost Corporation's contribution margin ratio is 20%.If

Q187: Chown Corporation,which has only one product,has provided

Q218: Jackson Industries uses a standard cost system

Q417: Eliezrie Corporation makes a product with the