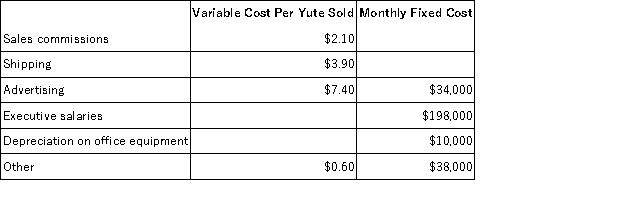

Poriss Corporation makes and sells a single product called a Yute.The company is in the process of preparing its Selling and Administrative Expense Budget for the last quarter of the year.The following budget data are available:  All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the company has budgeted to sell 19,000 Yutes in November,then the total budgeted selling and administrative expenses for November would be:

All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the company has budgeted to sell 19,000 Yutes in November,then the total budgeted selling and administrative expenses for November would be:

Definitions:

CCA Class

Refers to the Canadian tax system's categorization of depreciable property into classes, with each class having its own rate for capital cost allowance purposes.

Corporate Tax Rate

The percentage of a corporation's profits that are paid to the government as tax, varying by country and sometimes also by the size or type of corporation.

CCA Tax Shield

The CCA tax shield is a reduction in taxable income for businesses, achieved through claiming depreciation on assets, as permitted by tax laws.

Q10: Keefe Corporation has two divisions: Western Division

Q24: Data concerning Sumter Corporation's single product appear

Q58: Jarvix Corporation,which has only one product,has provided

Q102: Trapp Corporation uses the weighted-average method in

Q112: Aaker Corporation,which has only one product,has provided

Q144: Boenisch Corporation produces and sells a single

Q185: Biery Corporation makes a product with the

Q203: Sekuterski Air uses two measures of activity,flights

Q206: Pardoe Inc. ,manufactures a single product in

Q409: Lartey Corporation's cost formula for its selling