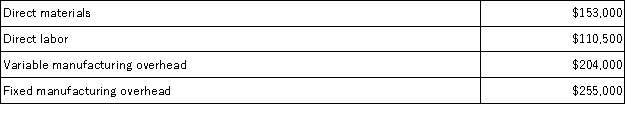

Harris Corporation produces a single product.Last year,Harris manufactured 17,000 units and sold 13,000 units.Production costs for the year were as follows:  Sales were $780,000 for the year,variable selling and administrative expenses were $88,400,and fixed selling and administrative expenses were $170,000.There was no beginning inventory.Assume that direct labor is a variable cost. The contribution margin per unit was:

Sales were $780,000 for the year,variable selling and administrative expenses were $88,400,and fixed selling and administrative expenses were $170,000.There was no beginning inventory.Assume that direct labor is a variable cost. The contribution margin per unit was:

Definitions:

Levator Scapulae

A skeletal muscle located at the back and side of the neck, responsible for elevating the scapula (shoulder blade).

Latissimus Dorsi

A broad muscle in the back that helps in movement of the arms and the torso.

Rhomboid Major

A skeletal muscle located in the upper back that connects the spine to the shoulder blades, responsible for retracting and rotating the scapula.

Trapezius

A large, triangular muscle extending over the back of the neck and shoulders, involved in moving, rotating, and stabilizing the scapula (shoulder blade) and extending the neck.

Q46: Guo Corporation uses the weighted-average method in

Q71: Angara Corporation uses activity-based costing to determine

Q74: The following information relates to the Blending

Q98: Assume a company sells a single product.If

Q118: Noel Enterprises has budgeted sales in units

Q140: Aaker Corporation,which has only one product,has provided

Q151: A common fixed cost is a fixed

Q199: The following labor standards have been established

Q201: Berends Corporation makes a product with the

Q348: Longview Hospital performs blood tests in its