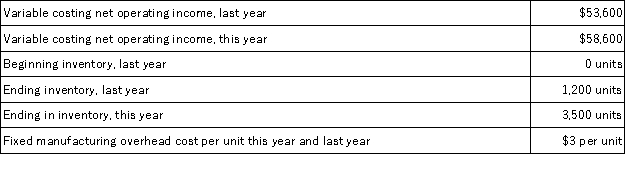

Romasanta Corporation manufactures a single product.The following data pertain to the company's operations over the last two years:  What was the absorption costing net operating income this year?

What was the absorption costing net operating income this year?

Definitions:

Tradable Emissions Permits

A market-based system that allows entities to buy or sell government-granted allotments of pollutants, promoting cost-effective pollution reduction.

Pollution Costs

entail the negative externalities or financial burdens on society resulting from environmental pollution.

Nondegradable Pollutants

Substances that do not break down naturally in the environment and can accumulate and cause harm over time.

Emissions Tax

A tax imposed on companies for the amount of greenhouse gases they emit into the atmosphere.

Q5: Criblez Corporation has two divisions: Blue Division

Q20: The Gerald Corporation makes and sells a

Q21: Sosinski Corporation has two divisions: Domestic Division

Q53: The term gross margin is used in

Q81: Pachero,Inc. ,manufactures and sells two products: Product

Q97: Meyer Corporation has two sales areas: North

Q109: The following information was taken from the

Q122: Salley Corporation produces and sells a single

Q174: O'Neill,Incorporated's segmented income statement for the most

Q194: Hatfield Corporation,which has only one product,has provided