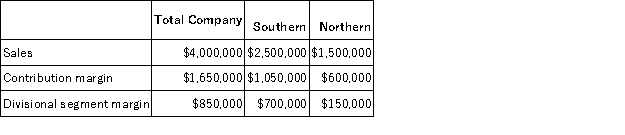

Nantua Corporation has two divisions,Southern and Northern.The following information was taken from last year's income statement segmented by division:  Net operating income last year for Nantua Corporation was $400,000. If the Northern Division's sales last year were $300,000 higher,how would this have changed Nantua's net operating income? (Assume no change in selling prices,variable expenses per unit,or fixed expenses. )

Net operating income last year for Nantua Corporation was $400,000. If the Northern Division's sales last year were $300,000 higher,how would this have changed Nantua's net operating income? (Assume no change in selling prices,variable expenses per unit,or fixed expenses. )

Definitions:

Diluted Earnings

Earnings per share calculated under the assumption that all convertible securities have been converted into common stock, providing a "worst case" scenario perspective on earnings per share.

Ownership Perspective

An approach or mindset focusing on the long-term benefits and responsibilities of owning an asset or investment.

GAAP

Generally Accepted Accounting Principles, a framework of accounting standards, principles, and procedures from which financial statements are prepared in the United States.

Cumulative

Pertaining to an aggregate or total amount added up over time, often used in context with dividends that are accumulated if not paid out.

Q34: The Prattle Corporation makes and sells only

Q48: Beakins Corporation produces a single product.The standard

Q50: Rogers Corporation is preparing its cash budget

Q55: Wall Corporation,which produces commercial safes,has provided the

Q68: Only variable manufacturing overhead costs are included

Q85: The Maxwell Corporation has a standard costing

Q144: The challenge in designing an activity-based costing

Q161: Romasanta Corporation manufactures a single product.The following

Q179: When using data from a segmented income

Q231: Sizzle Company uses a standard cost system