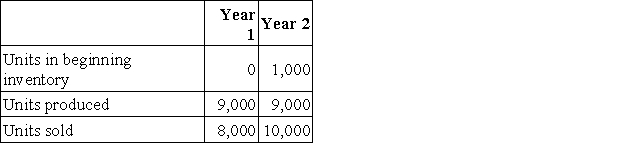

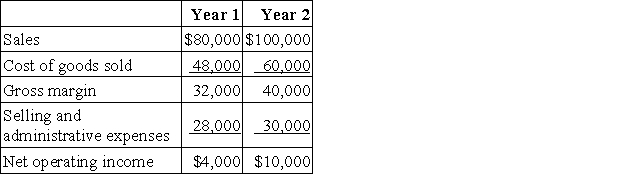

Hanks Corporation produces a single product.Operating data for the company and its absorption costing income statements for the last two years are presented below:

Variable manufacturing costs are $4 per unit.Fixed manufacturing overhead was $18,000 in each year.This fixed manufacturing overhead was applied at a rate of $2 per unit.Variable selling and administrative expenses were $1 per unit sold.

Variable manufacturing costs are $4 per unit.Fixed manufacturing overhead was $18,000 in each year.This fixed manufacturing overhead was applied at a rate of $2 per unit.Variable selling and administrative expenses were $1 per unit sold.

Required:

a.Compute the unit product cost in each year under variable costing.

b.Prepare new income statements for each year using variable costing.

c.Reconcile the absorption costing and variable costing net operating income for each year.

Definitions:

Q13: When materials are purchased in a process

Q22: Dilbert Farm Supply is located in a

Q62: Davey Corporation is preparing its Manufacturing Overhead

Q70: Florek Inc.produces and sells a single product.The

Q94: Hewett,Inc. ,manufactures and sells two products: Product

Q103: Dybala Corporation produces and sells a single

Q129: Seventy percent of Parlee Corporation's sales are

Q161: Romasanta Corporation manufactures a single product.The following

Q172: When preparing a production budget,the required production

Q402: Novelli Corporation makes a product whose variable