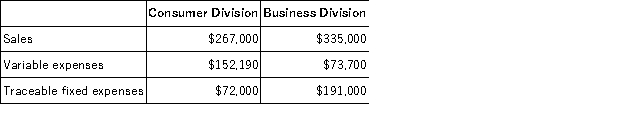

Phong Corporation has two divisions: Consumer Division and Business Division.The following data are for the most recent operating period:  The company's common fixed expenses total $102,340. The company's overall break-even sales is closest to:

The company's common fixed expenses total $102,340. The company's overall break-even sales is closest to:

Definitions:

Capital Lease

A lease arrangement that transfers substantially all the risks and rewards of ownership of an asset to the lessee, essentially treated as a purchase.

Retained Earnings

The portion of net earnings not paid out as dividends but instead reinvested in the company or used to pay off debt.

Deferred Income Taxes

Taxes applicable on income that is recognized in financial statements in one period but is taxable in another period.

Income Taxes Payable

Income taxes payable is a liability account on a company's balance sheet representing the amount of income taxes that the company owes to the government but has not yet paid.

Q2: The impact on net operating income of

Q6: In May,one of the processing departments at

Q33: Data for March for Lazarus Corporation and

Q39: Under variable costing,product cost does not contain

Q40: Punches,Inc. ,manufactures and sells two products: Product

Q51: Oleksy Corporation uses the weighted-average method in

Q63: In December,one of the processing departments at

Q72: Last year,Hruska Corporation's variable costing net operating

Q194: Hatfield Corporation,which has only one product,has provided

Q195: Pachero,Inc. ,manufactures and sells two products: Product