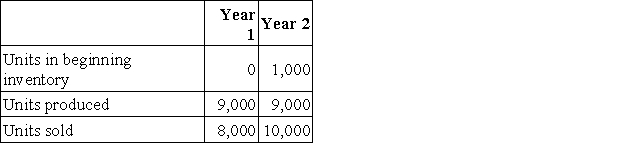

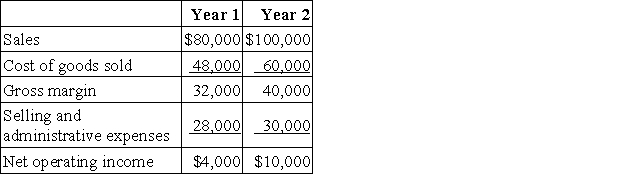

Hanks Corporation produces a single product.Operating data for the company and its absorption costing income statements for the last two years are presented below:

Variable manufacturing costs are $4 per unit.Fixed manufacturing overhead was $18,000 in each year.This fixed manufacturing overhead was applied at a rate of $2 per unit.Variable selling and administrative expenses were $1 per unit sold.

Variable manufacturing costs are $4 per unit.Fixed manufacturing overhead was $18,000 in each year.This fixed manufacturing overhead was applied at a rate of $2 per unit.Variable selling and administrative expenses were $1 per unit sold.

Required:

a.Compute the unit product cost in each year under variable costing.

b.Prepare new income statements for each year using variable costing.

c.Reconcile the absorption costing and variable costing net operating income for each year.

Definitions:

Blocking Variable

A variable used in experimental design to account for potential variation across experimental units, thereby reducing the impact of confounding variables.

Dosage Level

The amount of a substance, such as medication or chemical, administered or required to achieve a desired effect.

Randomized Block Design

A statistical design in experimental research that aims to reduce variability by grouping similar experimental units into blocks before randomly assigning treatments within each block.

LSAT Scores

Numerical scores derived from the Law School Admission Test, used to assess law school applicants' readiness for law school admissions.

Q43: Home Corporation will open a new store

Q75: A national retail company has segmented its

Q106: Machuga,Inc. ,manufactures and sells two products: Product

Q109: Using process costing,it is necessary to consider

Q127: Which of the following budgets are prepared

Q133: Poriss Corporation makes and sells a single

Q143: Routit Corporation had the following sales and

Q171: Facility-level activities are activities that are carried

Q340: Eliezrie Corporation makes a product with the

Q352: Smyer Corporation makes a product with the