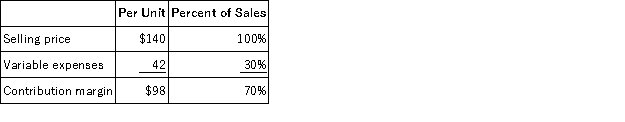

Hartung Corporation produces and sells a single product.Data concerning that product appear below:  Fixed expenses are $147,000 per month.The company is currently selling 2,000 units per month.The marketing manager would like to introduce sales commissions as an incentive for the sales staff.The marketing manager has proposed a commission of $13 per unit.In exchange,the sales staff would accept a decrease in their salaries of $22,000 per month.(This is the company's savings for the entire sales staff. ) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 400 units.What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $147,000 per month.The company is currently selling 2,000 units per month.The marketing manager would like to introduce sales commissions as an incentive for the sales staff.The marketing manager has proposed a commission of $13 per unit.In exchange,the sales staff would accept a decrease in their salaries of $22,000 per month.(This is the company's savings for the entire sales staff. ) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 400 units.What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Inventory

The total quantity of goods that a company has in stock, including raw materials, work-in-progress, and finished goods, used to meet customer demand.

Remanufacturing

The process of rebuilding a product to specifications of the original manufactured product using a combination of reused, repaired, and new parts.

Margins

The difference between the cost of goods sold and the selling price, indicating the profit per unit sold.

Emissions

The release of pollutants into the air, including those from industrial processes, transportation, and other sources that can harm human health and the environment.

Q32: Neldon,Inc. ,manufactures and sells two products: Product

Q47: Home Corporation will open a new store

Q78: For May,Young Corporation has budgeted its cash

Q85: In February,one of the processing departments at

Q108: Lepage Corporation has provided its contribution format

Q117: Guo Corporation uses the weighted-average method in

Q126: Fullard,Inc. ,manufactures and sells two products: Product

Q186: Khanam Corporation,which has only one product,has provided

Q221: Pevy Corporation has two divisions: Southern Division

Q232: Hartz Urban Diner is a charity supported