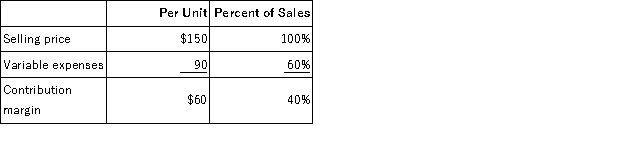

Data concerning Wythe Corporation's single product appear below:  Fixed expenses are $106,000 per month.The company is currently selling 2,000 units per month.The marketing manager would like to cut the selling price by $15 and increase the advertising budget by $5,000 per month.The marketing manager predicts that these two changes would increase monthly sales by 800 units.What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $106,000 per month.The company is currently selling 2,000 units per month.The marketing manager would like to cut the selling price by $15 and increase the advertising budget by $5,000 per month.The marketing manager predicts that these two changes would increase monthly sales by 800 units.What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Tax

A financial charge imposed by the government, required for the support of the government and public services.

Tax Per Unit

A tax imposed on goods or services that is based on a fixed amount for each unit sold.

Paperback Novels

Books printed on lower-quality paper with soft covers, typically more affordable and portable than their hardcover counterparts.

Gasoline

A volatile, flammable liquid derived from petroleum, used chiefly as fuel in internal-combustion engines.

Q19: Frogge,Inc. ,manufactures and sells two products: Product

Q28: A manufacturer of tiling grout has supplied

Q37: Morie Corporation is working on its direct

Q41: If a company operates at the break

Q46: Guo Corporation uses the weighted-average method in

Q54: A sales budget is given below for

Q67: The selling and administrative expense budget of

Q70: The following data have been provided by

Q107: The Dean Corporation produces and sells a

Q135: Froio Corporation produces and sells two products.Data