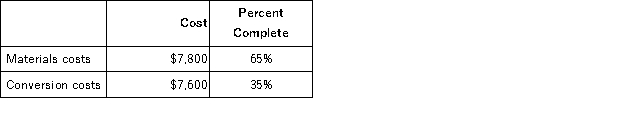

Fulton Corporation uses the weighted-average method in its process costing system.This month,the beginning inventory in the first processing department consisted of 800 units.The costs and percentage completion of these units in beginning inventory were:  A total of 9,900 units were started and 8,900 units were transferred to the second processing department during the month.The following costs were incurred in the first processing department during the month:

A total of 9,900 units were started and 8,900 units were transferred to the second processing department during the month.The following costs were incurred in the first processing department during the month:  The ending inventory was 70% complete with respect to materials and 60% complete with respect to conversion costs. Note: Your answers may differ from those offered below due to rounding error.In all cases,select the answer that is the closest to the answer you computed.To reduce rounding error,carry out all computations to at least three decimal places.

The ending inventory was 70% complete with respect to materials and 60% complete with respect to conversion costs. Note: Your answers may differ from those offered below due to rounding error.In all cases,select the answer that is the closest to the answer you computed.To reduce rounding error,carry out all computations to at least three decimal places.

The total cost transferred from the first processing department to the next processing department during the month is closest to:

Definitions:

Natural-Language Recognition

The ability of a computer to understand and interpret human language as it is spoken or written.

Banner Health

A large non-profit healthcare system in the United States that operates hospitals and other health services facilities.

Call Center

A centralized department to which phone calls from current and potential customers are directed for handling queries, issues, and information requests.

Buyer Power

The ability of consumers or purchasing entities to dictate terms and influence prices and quality in the market.

Q8: Paparo Corporation has provided the following data

Q31: Lagana Corporation uses process costing.The following data

Q55: All other things the same,an increase in

Q75: A national retail company has segmented its

Q84: Depreciation on office equipment would be included

Q90: Nelson Corporation,which has only one product,has provided

Q158: Masiclat,Inc. ,manufactures and sells two products: Product

Q165: Managing and sustaining product diversity requires many

Q173: At a sales volume of 37,000 units,Maks

Q201: Swifton Corporation produces a single product.Last year,the