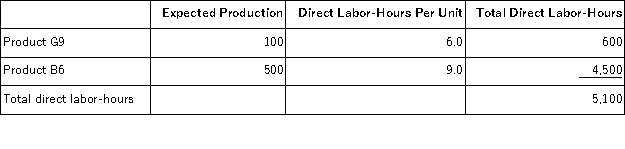

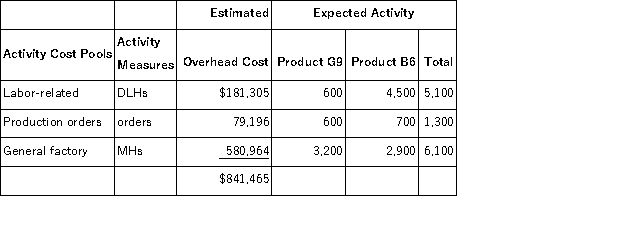

Bolerjack,Inc. ,manufactures and sells two products: Product G9 and Product B6.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $16.50 per DLH.The direct materials cost per unit is $204.30 for Product G9 and $284.50 for Product B6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $16.50 per DLH.The direct materials cost per unit is $204.30 for Product G9 and $284.50 for Product B6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product B6 under activity-based costing is closest to:

The unit product cost of Product B6 under activity-based costing is closest to:

Definitions:

Discount Rate

The interest rate used to discount future cash flows to present value, often applied in investment and finance to determine the present worth of future cash flows.

Carrying Amounts

The amount at which an asset or liability is recognized in the balance sheet, after deducting any accumulated depreciation, impairment, or amortization.

Contingent Asset

A potential asset that may arise depending on the outcome of a future event, not recognized in financial statements until certain.

AASB 137

An Australian Accounting Standards Board standard related to the accounting for provisions, contingent liabilities, and contingent assets.

Q73: Yankee Corporation manufactures a single product.The company

Q73: Collins Corporation uses a predetermined overhead rate

Q75: Comparative income statements for Tudor Retailing Company

Q133: The following entry would be used to

Q134: A manufacturer of tiling grout has supplied

Q136: Indirect materials are charged to specific jobs.

Q144: Monce Corporation has two divisions: Home Division

Q165: Krimton Corporation's manufacturing costs last year consisted

Q179: Maddaloni International,Inc. ,produces and sells a single

Q183: Hadrana Corporation reports that at an activity