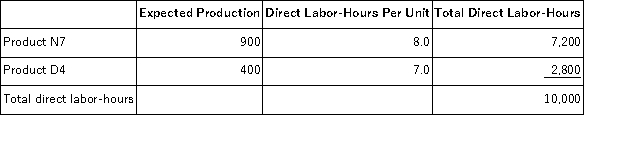

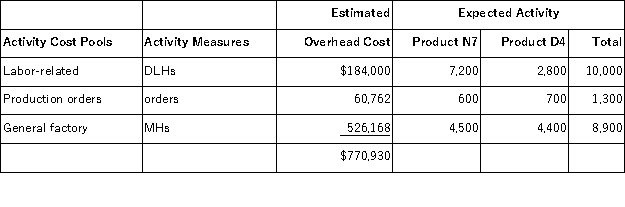

Sepulvado,Inc. ,manufactures and sells two products: Product N7 and Product D4.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $15.50 per DLH.The direct materials cost per unit is $197.00 for Product N7 and $290.50 for Product D4. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $15.50 per DLH.The direct materials cost per unit is $197.00 for Product N7 and $290.50 for Product D4. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product D4 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product D4 would be closest to:

Definitions:

Selling Price

The amount of money for which a product is sold to the customer, not necessarily reflecting its cost or intrinsic value.

Department Spend

Relates to the total amount of money allocated and spent by a specific department within an organization.

Ensuring Budget

A financial plan that is designed to make sure all finances are covered and allocated appropriately for a certain period, often aimed at preventing overspending or deficits.

Business Planning Spectrum

Encompasses the variety of strategic and operational planning activities within a business, from long-term vision setting to short-term action planning.

Q13: An unfavorable materials price variance is recorded

Q69: Sigel Corporation bases its predetermined overhead rate

Q71: A company that makes organic fertilizer has

Q94: The contribution margin ratio is equal to:<br>A)Total

Q105: Kosco Corporation produces a single product.The company's

Q131: Moonen Corporation produces and sells a single

Q146: In activity-based costing,unit product costs computed for

Q180: Mouret Corporation uses the following activity rates

Q181: Product costs are recorded as expenses in

Q197: Accurso,Inc. ,manufactures and sells two products: Product