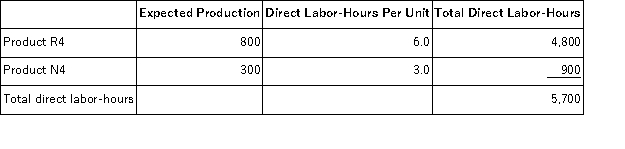

Serva,Inc. ,manufactures and sells two products: Product R4 and Product N4.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $24.70 per DLH.The direct materials cost per unit for each product is given below:

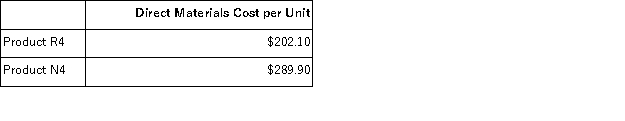

The direct labor rate is $24.70 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

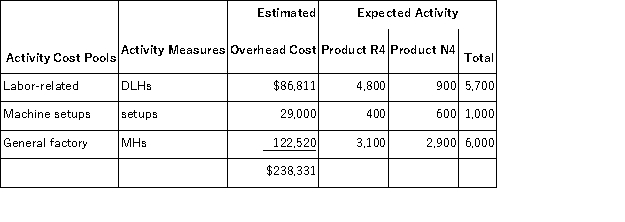

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The overhead applied to each unit of Product N4 under activity-based costing is closest to:

The overhead applied to each unit of Product N4 under activity-based costing is closest to:

Definitions:

Consolidated Balance Sheet

A financial statement that presents the assets, liabilities, and shareholders' equity of a conglomerate, combining the figures of the parent company and its subsidiaries.

Partial Equity Method

An accounting approach used for investments where the investor has significant influence (but not control) over the investee, leading to the recognition of their share of the investee's earnings.

Amortization

The gradual reduction of the book value of an intangible asset or the paying down of a debt over a fixed period of time.

Consolidation Worksheet

An accounting tool used to combine the financial statements of a parent company and its subsidiaries, enabling the preparation of consolidated financial statements.

Q21: Cridberg Corporation's selling and administrative expenses for

Q45: Crossland Corporation reported sales on its income

Q47: Kuzuck Corporation uses the weighted-average method in

Q80: Sanes Corporation produces and sells a single

Q84: Compute the amount of raw materials used

Q86: Dodd Corporation uses the weighted-average method in

Q125: Iaci Corporation is a wholesaler that sells

Q129: Eddy Corporation has provided the following production

Q179: Younger Corporation reports that at an activity

Q186: Penegar,Inc. ,manufactures and sells two products: Product