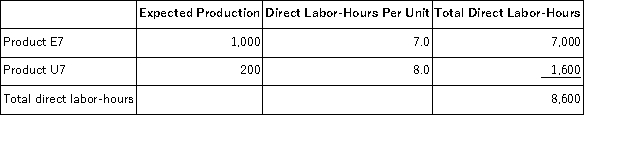

Hewett,Inc. ,manufactures and sells two products: Product E7 and Product U7.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $29.50 per DLH.The direct materials cost per unit is $164.10 for Product E7 and $289.50 for Product U7. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

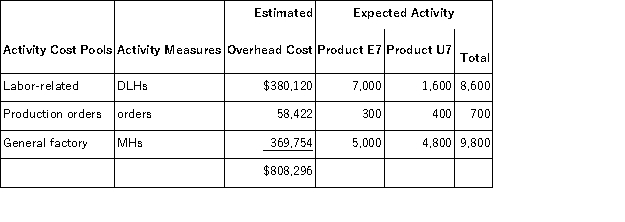

The direct labor rate is $29.50 per DLH.The direct materials cost per unit is $164.10 for Product E7 and $289.50 for Product U7. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The activity rate for the Production Orders activity cost pool under activity-based costing is closest to:

The activity rate for the Production Orders activity cost pool under activity-based costing is closest to:

Definitions:

Wage Structure

The organization and scaling of wages within an organization, setting the relative pay levels for different roles or job grades.

Job Evaluation

A systematic process used to ascertain the relative worth of jobs within an organization to establish a fair and equitable pay structure.

Total Value

The combined worth of all the components of an asset or company, often considered in financial terms.

Compensation Policies

Guidelines and practices established by an organization to determine how employees are compensated, including wages, salaries, benefits, and bonuses.

Q6: Sill,Inc. ,manufactures and sells two products: Product

Q25: Brusveen Corporation applies manufacturing overhead to jobs

Q26: During February at Iniquez Corporation,$79,000 of raw

Q37: Torbert,Inc. ,produces and sells a single product.The

Q48: Farnor,Inc. ,would like to estimate the variable

Q65: The following accounts are from last year's

Q124: Accurso,Inc. ,manufactures and sells two products: Product

Q132: Dillon Corporation applies manufacturing overhead to jobs

Q181: Product costs are recorded as expenses in

Q183: Schoeninger,Inc. ,manufactures and sells two products: Product