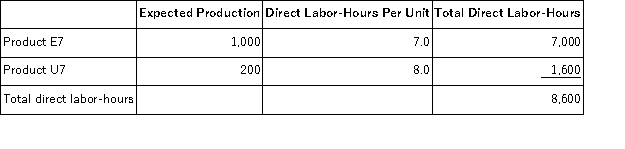

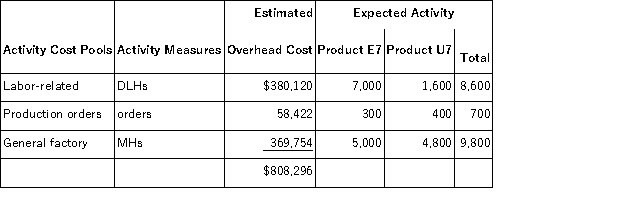

Hewett,Inc. ,manufactures and sells two products: Product E7 and Product U7.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $29.50 per DLH.The direct materials cost per unit is $164.10 for Product E7 and $289.50 for Product U7. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $29.50 per DLH.The direct materials cost per unit is $164.10 for Product E7 and $289.50 for Product U7. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product U7 under activity-based costing is closest to:

The unit product cost of Product U7 under activity-based costing is closest to:

Definitions:

Small U.S. Stocks

Refers to shares of smaller companies in the United States, typically characterized by a lower market capitalization.

Long-Term U.S. Treasury Bonds

Government bonds with maturities typically longer than 10 years, considered among the safest investment securities.

Market Risk Premium

The excess return that investors require for choosing to invest in the stock market over a risk-free asset.

Index Fund

A type of mutual fund or exchange-traded fund (ETF) designed to follow the returns of a specific market index.

Q4: Digby Corporation's balance sheet and income statement

Q20: Carver Inc.uses the weighted-average method in its

Q31: Acton Corporation,which applies manufacturing overhead on the

Q45: Crossland Corporation reported sales on its income

Q61: An example of a discretionary fixed cost

Q67: The actual manufacturing overhead incurred at Fraze

Q78: Hewett,Inc. ,manufactures and sells two products: Product

Q90: The July contribution format income statement of

Q132: Clemmens Corporation has two major business segments:

Q147: Comco,Inc.has accumulated the following data for the