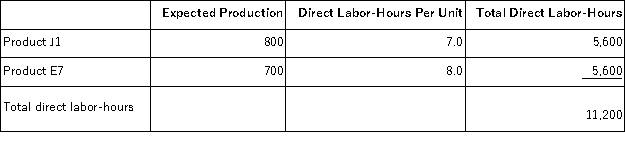

Minon,Inc. ,manufactures and sells two products: Product J1 and Product E7.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $19.90 per DLH.The direct materials cost per unit for each product is given below:

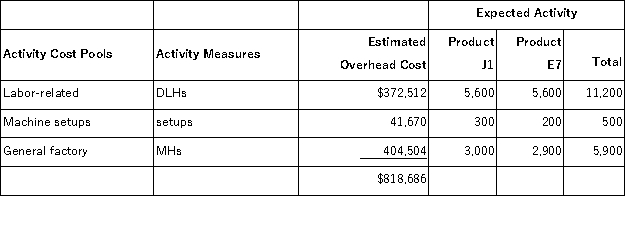

The direct labor rate is $19.90 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The overhead applied to each unit of Product J1 under activity-based costing is closest to:

The overhead applied to each unit of Product J1 under activity-based costing is closest to:

Definitions:

Third-party Payer

An entity (usually an insurance company or government agency) that pays medical expenses on behalf of the patient.

Elective Procedure

A medical procedure that is not required to sustain life but is requested for payment to the third-party payer by the patient or physician. Some elective procedures are paid for by third-party payers, whereas others are not.

Predetermination

The act of deciding or establishing something in advance or having a predetermined outcome.

Third-party Payer

An entity (other than the patient or healthcare provider) responsible for paying medical expenses, such as insurance companies.

Q15: Alden Company recorded the following transactions for

Q17: Dorris Corporation's balance sheet and income statement

Q21: In computing its predetermined overhead rate,Brady Company

Q42: Bolerjack,Inc. ,manufactures and sells two products: Product

Q53: Carson Corporation's comparative balance sheet and income

Q64: Nethery,Inc. ,manufactures and sells two products: Product

Q82: Pultz Corporation produces and sells a single

Q118: The degree of operating leverage in a

Q120: Angara Corporation uses activity-based costing to determine

Q163: Searls Corporation,a merchandising company,reported the following results