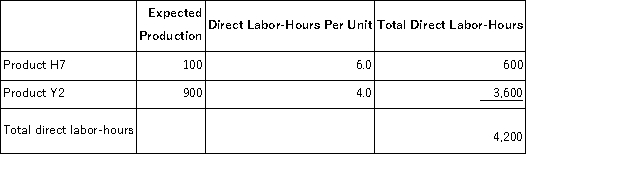

Punches,Inc. ,manufactures and sells two products: Product H7 and Product Y2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $17.80 per DLH.The direct materials cost per unit for each product is given below:

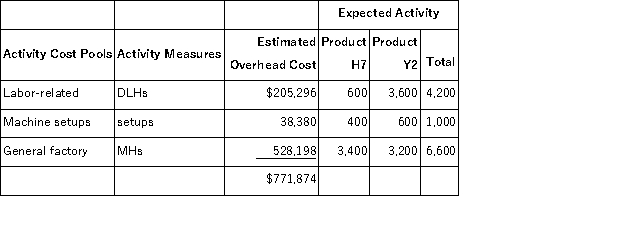

The direct labor rate is $17.80 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The overhead applied to each unit of Product Y2 under activity-based costing is closest to:

The overhead applied to each unit of Product Y2 under activity-based costing is closest to:

Definitions:

Direct Materials

Direct materials are raw materials that are directly traceable to the manufacturing of a product and are a significant component of the total manufacturing cost.

Variable Manufacturing Overhead

Costs involved in the manufacturing process that fluctuate with the level of production, such as utility expenses or materials costs.

Absorption Costing

An accounting method that includes all manufacturing costs—direct materials, direct labor, and both variable and fixed manufacturing overhead—in the cost of a product.

Absorption Costing

This method includes all manufacturing costs (direct materials, direct labor, and both variable and fixed manufacturing overhead) in the cost of a product.

Q8: Sales reported on the income statement totaled

Q11: James just received an $8,000 inheritance check

Q11: An unfavorable labor efficiency variance is recorded

Q21: Cridberg Corporation's selling and administrative expenses for

Q56: Messana Corporation reported the following data for

Q59: Dameron,Inc. ,manufactures and sells two products: Product

Q61: Criblez Corporation has two divisions: Blue Division

Q76: Minon,Inc. ,manufactures and sells two products: Product

Q145: The margin of safety in dollars equals

Q171: Country Charm Restaurant is open 24 hours