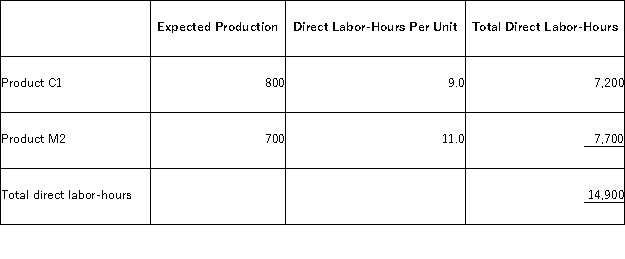

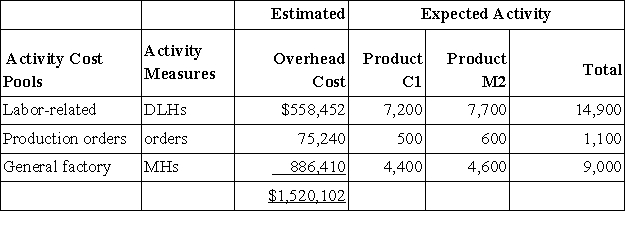

Machuga,Inc. ,manufactures and sells two products: Product C1 and Product M2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $18.70 per DLH.The direct materials cost per unit is $297.00 for Product C1 and $246.20 for Product M2. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $18.70 per DLH.The direct materials cost per unit is $297.00 for Product C1 and $246.20 for Product M2. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The overhead applied to each unit of Product M2 under activity-based costing is closest to:

The overhead applied to each unit of Product M2 under activity-based costing is closest to:

Definitions:

Collect Like Terms

The process of simplifying an algebraic expression by combining terms that have the same variable raised to the same power.

Operation Indicated

The process of performing the mathematical operation suggested by a given situation or problem.

Final Value

The last or concluding worth of an investment or financial product, often after a set period or upon maturity.

Formula

A mathematical relationship or rule expressed in symbols, typically representing the relationship between different quantities.

Q5: Harry has just inherited $300,000.Harry has decided

Q11: The following T-accounts have been constructed from

Q15: Alden Company recorded the following transactions for

Q22: Baker Corporation applies manufacturing overhead on the

Q30: Manufacturing overhead is overapplied if actual manufacturing

Q80: The sum of all amounts transferred from

Q82: The cost of factory machinery purchased last

Q97: The following production and average cost data

Q126: When the activity level declines within the

Q135: Froio Corporation produces and sells two products.Data