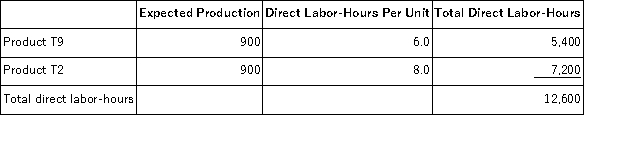

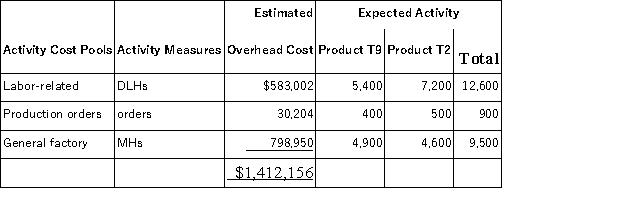

Brenneis,Inc. ,manufactures and sells two products: Product T9 and Product T2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $18.10 per DLH.The direct materials cost per unit is $115.20 for Product T9 and $221.40 for Product T2. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $18.10 per DLH.The direct materials cost per unit is $115.20 for Product T9 and $221.40 for Product T2. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product T9 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product T9 would be closest to:

Definitions:

Laundry Bag

A bag used for collecting, transporting, and possibly sorting dirty laundry before washing.

Superfatted Soap

A type of soap that contains extra fats or oils, beyond what is needed to react with the lye, to moisturize the skin.

Microorganisms

Tiny living organisms, such as bacteria, viruses, fungi, and protozoa, that can only be seen under a microscope.

Contaminated

Something that has been made impure or unsuitable by contact or mixture with an unclean or harmful substance.

Q9: Commissions paid to salespersons are a variable

Q20: Jameson Corporation uses a predetermined overhead rate

Q29: The "costs to be accounted for" portion

Q32: Hache Corporation uses the weighted-average method in

Q54: Hayward Corporation had net sales of $610,000

Q85: A manufacturer of tiling grout has supplied

Q99: If Q equals the level of output,P

Q112: Conversion cost equals product cost less direct

Q136: Krimton Corporation's manufacturing costs last year consisted

Q141: Stott Company requires one full-time dock hand