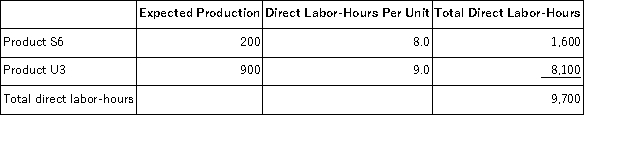

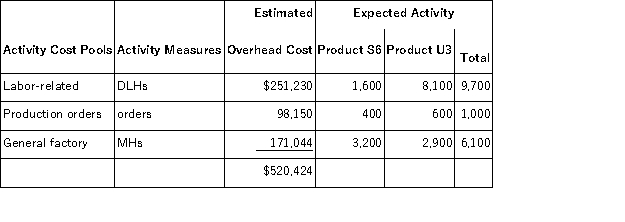

Sampaga,Inc. ,manufactures and sells two products: Product S6 and Product U3.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $20.90 per DLH.The direct materials cost per unit is $145.30 for Product S6 and $221.50 for Product U3. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $20.90 per DLH.The direct materials cost per unit is $145.30 for Product S6 and $221.50 for Product U3. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product U3 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product U3 would be closest to:

Definitions:

Discount Rate

The discount rate applied in the evaluation of discounted cash flow analysis to calculate the current value of future cash flows.

Sold Rooms Percentage

A metric in the hospitality industry that represents the ratio of rooms booked to the total number of available rooms, indicating occupancy rate and hotel performance.

Yield Management

A pricing strategy that aims to maximize revenue by dynamically setting prices based on the supply and demand for a product or service.

Operations Management

The administration of business practices aimed at ensuring maximum efficiency within a company, particularly in regard to the management of resources, production, and distribution of goods and services.

Q1: If the actual direct labor-hours used is

Q10: Frogge,Inc. ,manufactures and sells two products: Product

Q15: Carr Corporation's comparative balance sheet and income

Q41: Acklac Corporation uses the weighted-average method in

Q50: Joanette,Inc. ,manufactures and sells two products: Product

Q80: Sanes Corporation produces and sells a single

Q88: An unfavorable volume variance means that a

Q91: Lasseter Corporation has provided its contribution format

Q126: Fullard,Inc. ,manufactures and sells two products: Product

Q129: Villeda Corporation uses the following activity rates