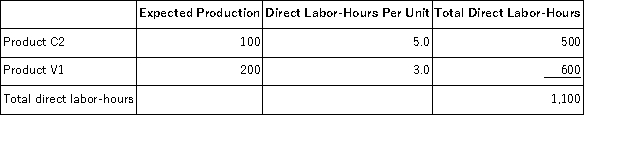

Klasinski,Inc. ,manufactures and sells two products: Product C2 and Product V1.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $26.40 per DLH.The direct materials cost per unit is $106.80 for Product C2 and $131.40 for Product V1.

The direct labor rate is $26.40 per DLH.The direct materials cost per unit is $106.80 for Product C2 and $131.40 for Product V1.

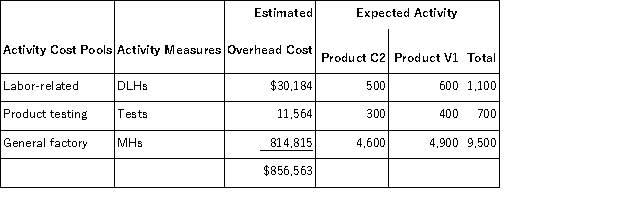

The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  Required:

Required:

Determine the unit product cost of each product under the activity-based costing method.

Definitions:

Publicly Disclosing

The act of making information or data known to the public, often through official reports or statements.

Provisional Measure

A temporary legal act or order intended to address urgent matters until a permanent solution is established or passed into law.

Legal Structures

The legally recognized configurations under which organizations or businesses can operate, such as sole proprietorships, partnerships, corporations, and limited liability companies.

Advantages

The favorable attributes or benefits that give an individual, product, or service a competitive edge over others.

Q4: Xiong Corporation makes a product that sells

Q40: Hache Corporation uses the weighted-average method in

Q65: The following accounts are from last year's

Q78: The following information relates to the Assembly

Q94: The contribution margin ratio is equal to:<br>A)Total

Q121: Arizaga Corporation manufactures canoes in two departments,Fabrication

Q128: Killian Corporation began operations on January 1.The

Q146: In activity-based costing,unit product costs computed for

Q151: Kodama Corporation staffs a helpline to answer

Q179: Younger Corporation reports that at an activity