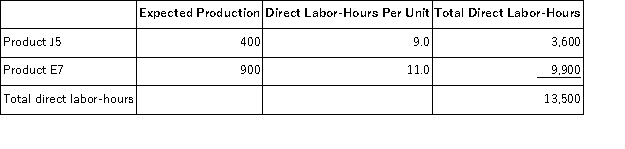

Dameron,Inc. ,manufactures and sells two products: Product J5 and Product E7.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $15.90 per DLH.The direct materials cost per unit for each product is given below:

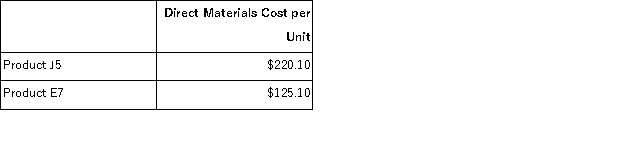

The direct labor rate is $15.90 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

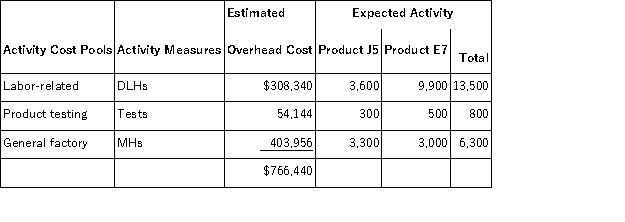

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  Required:

Required:

In all computations involving dollars in the following requirements,round off your answer to the nearest whole cent.

a.Compute the activity rates under the activity-based costing system.

b.Determine how much overhead would be assigned to each product under the activity-based costing system.

c.Determine the unit product cost of each product under the activity-based costing method.

Definitions:

Dividend

A portion of a company's earnings distributed to shareholders, usually in the form of cash or additional stock.

Fed Funds Rate

The interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight.

Equilibrium Levels

The point at which market supply and demand balance each other, and as a result, prices become stable.

Real Interest Rates

Measures the borrowing cost of money after adjusting for inflation, providing a clearer view of the true cost of borrowing or the true yield on an investment.

Q26: In September,one of the processing departments at

Q38: When the weighted-average method of process costing

Q74: The July contribution format income statement of

Q92: Preyer Corporation produces and sells a single

Q110: Calip Corporation,a merchandising company,reported the following results

Q113: A company that makes organic fertilizer has

Q115: Bohringer,Inc. ,manufactures and sells two products: Product

Q138: Stoppkotte Corporation has provided its contribution format

Q140: All other things the same,a reduction in

Q153: Boenisch Corporation produces and sells a single