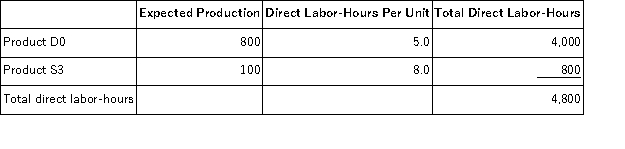

Besser,Inc. ,manufactures and sells two products: Product D0 and Product S3.Data concerning the expected production of each product and the  The direct labor rate is $24.70 per DLH.The direct materials cost per unit for each product is given below:

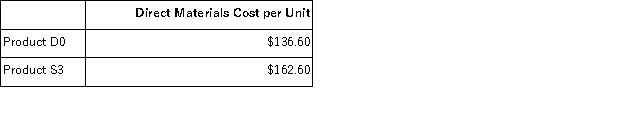

The direct labor rate is $24.70 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

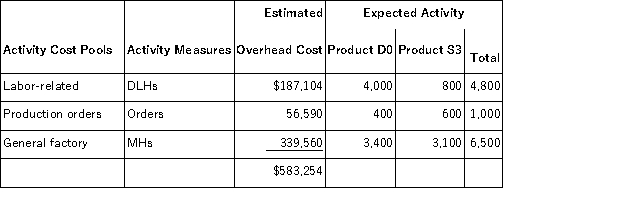

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  Required:

Required:

In all computations involving dollars in the following requirements,round off your answer to the nearest whole cent.

a.The company currently uses a traditional costing method in which overhead is applied to products based solely on direct labor-hours.Compute the company's predetermined overhead rate under this costing method.

b.How much overhead would be applied to each product under the company's traditional costing method?

c.Determine the unit product cost of each product under the company's traditional costing method.

d.Compute the activity rates under the activity-based costing system.

e.Determine how much overhead would be assigned to each product under the activity-based costing system.

f.Determine the unit product cost of each product under the activity-based costing method.

g.What is the difference between the overhead per unit under the traditional costing method and the activity-based costing system for each of the two products?

h.What is the difference between the unit product costs under the under the traditional costing method and the activity-based costing system for each of the two products?

Definitions:

Literature Database

A digital or online collection of academic publications and references, facilitating research and access to scholarly articles and information.

CINAHL

An acronym for Cumulative Index to Nursing and Allied Health Literature; a comprehensive source of articles for nurses and allied health professionals.

Diabetic Neuropathy

A type of nerve damage that can occur in individuals with diabetes, leading to numbness, pain, and weakness, particularly in the limbs.

Literature Search

A systematic and thorough search for information and publications on a specific topic, often conducted as part of academic research.

Q1: Bohlen Corporation produces and sells a single

Q27: Paolello,Inc. ,manufactures and sells two products: Product

Q31: Ungvarsky Corporation has provided the following data

Q39: Data concerning Cutshall Enterprises Corporation's single product

Q82: Pultz Corporation produces and sells a single

Q104: In December,one of the processing departments at

Q105: Omary Corporation has a standard cost system

Q124: Ence Sales,Inc. ,a merchandising company,reported sales of

Q140: Management of Childers Corporation is considering whether

Q166: An activity in activity-based costing is an