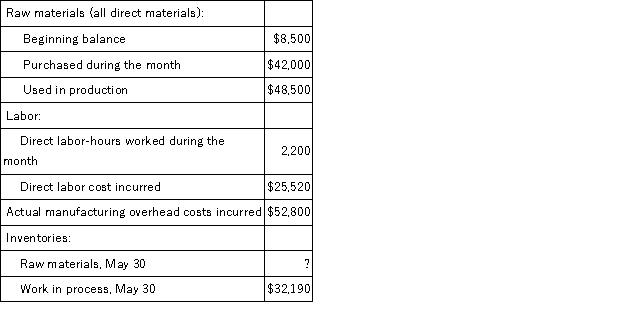

Dapper Corporation had only one job in process on May 1.The job had been charged with $3,400 of direct materials,$4,640 of direct labor,and $9,200 of manufacturing overhead cost.The company assigns overhead cost to jobs using the predetermined overhead rate of $23.00 per direct labor-hour. During May,the following activity was recorded:  Work in process inventory on May 30 contains $7,540 of direct labor cost.Raw materials consist solely of items that are classified as direct materials.

Work in process inventory on May 30 contains $7,540 of direct labor cost.Raw materials consist solely of items that are classified as direct materials.

The balance in the raw materials inventory account on May 30 was:

Definitions:

United States Supreme Court

The highest court in the federal judiciary of the United States, established pursuant to Article III of the U.S. Constitution, with ultimate appellate jurisdiction over all federal court and state court cases that involve a point of federal law.

Federal Court

A court established under the federal judicial system of a country, often having jurisdiction over matters involving national laws or disputes between states or between a state and citizens of another state.

Computer System

An integrated set of hardware and software designed to process data and produce a desirable output.

Record on Appeal

A complete collection of all documents, evidence, and transcripts from a trial court that are presented to an appellate court for review.

Q7: Nieman Inc. ,a local retailer,has provided the

Q15: Carr Corporation's comparative balance sheet and income

Q24: In a traditional format income statement for

Q41: Cassano,Inc. ,manufactures and sells two products: Product

Q56: Messana Corporation reported the following data for

Q67: The actual manufacturing overhead incurred at Fraze

Q80: Faessler Corporation applies overhead to products based

Q90: Jublot Corporation uses the weighted-average method in

Q102: Overmeyer,Inc. ,manufactures and sells two products: Product

Q107: The Dillon Corporation makes and sells a