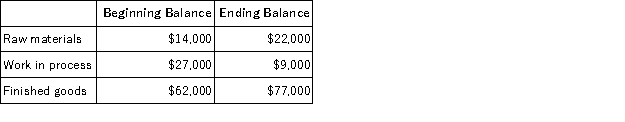

Bakerston Company is a manufacturing firm that uses job-order costing.The company's inventory balances were as follows at the beginning and end of the year:  The company applies overhead to jobs using a predetermined overhead rate based on machine-hours.At the beginning of the year,the company estimated that it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead cost.The following transactions were recorded for the year:

The company applies overhead to jobs using a predetermined overhead rate based on machine-hours.At the beginning of the year,the company estimated that it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead cost.The following transactions were recorded for the year:

• Raw materials were purchased,$315,000.

• Raw materials were requisitioned for use in production,$307,000 ($281,000 direct and $26,000 indirect).

• The following employee costs were incurred: direct labor,$377,000;indirect labor,$96,000;and administrative salaries,$172,000.

• Selling costs,$147,000.

• Factory utility costs,$10,000.

• Depreciation for the year was $127,000 of which $120,000 is related to factory operations and $7,000 is related to selling,general,and administrative activities.

• Manufacturing overhead was applied to jobs.The actual level of activity for the year was 34,000 machine-hours.

• Sales for the year totaled $1,253,000.

Required:

a.Prepare a schedule of cost of goods manufactured.

b.Was the overhead underapplied or overapplied? By how much?

c.Prepare an income statement for the year.The company closes any underapplied or overapplied overhead to Cost of Goods Sold.

Definitions:

Q25: The most recent balance sheet and income

Q66: During January,Shanker Corporation recorded the following: <img

Q77: Jimmy Corporation uses the weighted-average method in

Q78: If all four of Argo Corporation's overhead

Q86: Dodd Corporation uses the weighted-average method in

Q105: During the month of April,direct labor cost

Q112: Aksamit Corporation bases its predetermined overhead rate

Q126: Fullard,Inc. ,manufactures and sells two products: Product

Q137: Anderson Corporation has provided the following production

Q175: At an activity level of 8,300 machine-hours