The Commonwealth Company uses a job-order costing system and applies manufacturing overhead cost to jobs using a predetermined overhead rate based on the cost of materials used in production.At the beginning of the year,the following estimates were made as a basis for computing the predetermined overhead rate: manufacturing overhead cost,$186,000;direct materials cost,$155,000.The following transactions took place during the year (all purchases and services were acquired on account):

a.Raw materials purchased,$96,000.

b.Raw materials requisitioned for use in production (all direct materials),$88,000.

c.Utility bills incurred in the factory,$17,000.

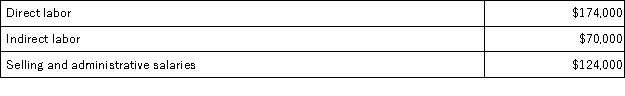

d.Costs for salaries and wages incurred as follows:  e.Maintenance costs incurred in the factory,$12,000.

e.Maintenance costs incurred in the factory,$12,000.

f.Advertising costs incurred,$98,000.

g.Depreciation recorded for the year,$75,000 (75 percent relates to factory assets and the remainder relates to selling,general,and administrative assets).

h.Rental cost incurred on buildings,$80,000 (80 percent of the space is occupied by the factory,and 20 percent is occupied by sales and administration).

i.Miscellaneous selling,general,and administrative costs incurred,$12,000.

j.Manufacturing overhead cost was applied to jobs.

k.Cost of goods manufactured for the year,$480,000.

l.Sales for the year (all on account)totaled $900,000.These goods cost $550,000 to manufacture.

Required:

Prepare journal entries to record the information above.Key your entries by the letters a through l.

Definitions:

Job Dissatisfaction

a negative feeling about one's job that arises due to various factors such as inadequate pay, poor working conditions, or mismatch with career goals.

Affective Commitment

The emotional attachment, identification, and involvement an employee has with their organization and its goals.

Organizational Citizenship Behaviors

Employee behaviors that contribute to the overall effectiveness of an organization, going beyond the required duties.

Job Satisfaction

The level of contentment employees feel about their work, which can affect performance and turnover.

Q29: The change in each of Kendall Corporation's

Q45: Fresh Wreath Corporation manufactures wreaths according to

Q50: The Murray Corporation makes and sells a

Q71: Job 231 was recently completed.The following data

Q91: The cost categories that appear on a

Q100: Bradbeer Corporation uses direct labor-hours in its

Q103: Inspection costs at one of Iuliano Corporation's

Q114: Which of the following would most likely

Q149: Swagg Jewelry Corporation manufactures custom jewelry.In the

Q162: Property taxes on a manufacturing facility are