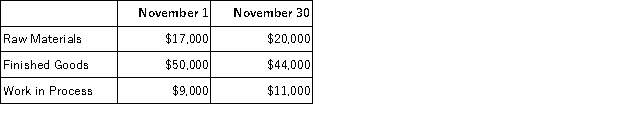

Meyers Corporation had the following inventory balances at the beginning and end of November:  During November,$39,000 in raw materials (all direct materials) were drawn from inventory and used in production.The company's predetermined overhead rate was $8 per direct labor-hour,and it paid its direct labor workers $10 per hour.A total of 300 hours of direct labor time had been expended on the jobs in the beginning Work in Process inventory account.The ending Work in Process inventory account contained $4,700 of direct materials cost.The Corporation incurred $28,000 of actual manufacturing overhead cost during the month and applied $26,400 in manufacturing overhead cost. The amount of direct labor cost in the November 30 Work in Process inventory was:

During November,$39,000 in raw materials (all direct materials) were drawn from inventory and used in production.The company's predetermined overhead rate was $8 per direct labor-hour,and it paid its direct labor workers $10 per hour.A total of 300 hours of direct labor time had been expended on the jobs in the beginning Work in Process inventory account.The ending Work in Process inventory account contained $4,700 of direct materials cost.The Corporation incurred $28,000 of actual manufacturing overhead cost during the month and applied $26,400 in manufacturing overhead cost. The amount of direct labor cost in the November 30 Work in Process inventory was:

Definitions:

Deferred Tax Liability

It's a tax obligation that arises from income already earned and recorded for accounting purposes, but payment is deferred to the IRS until a future date.

Subsidiary

An entity that is controlled by a higher entity, usually through majority shareholding, and is included in the financial statements of the controlling entity through consolidation.

Investment

The allocation of resources, usually financial, in expectation of a future return or profit.

Equity

The value of an ownership interest in a company, represented by the portion of the company's assets that would be distributed to shareholders after settling all liabilities.

Q28: In the past,Hypochondriac Hospital allocated all of

Q43: Reven Corporation prepares its statement of cash

Q52: Indirect labor is a(n):<br>A)Prime cost.<br>B)Conversion cost.<br>C)Period cost.<br>D)Opportunity

Q54: Barbu Corporation has provided the following data

Q68: Scarff,Inc. ,manufactures and sells two products: Product

Q84: Gould Corporation uses the following activity rates

Q93: Pizzi,Inc.had the following fixed manufacturing overhead variances

Q111: Data concerning Marchman Corporation's single product appear

Q113: A disadvantage of vertical integration is that

Q184: Callicott Corporation produces a product that sells