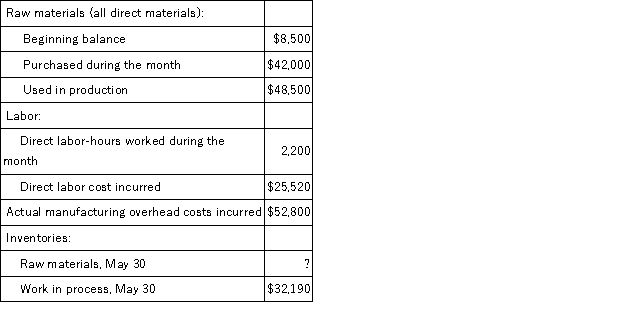

Dapper Corporation had only one job in process on May 1.The job had been charged with $3,400 of direct materials,$4,640 of direct labor,and $9,200 of manufacturing overhead cost.The company assigns overhead cost to jobs using the predetermined overhead rate of $23.00 per direct labor-hour. During May,the following activity was recorded:  Work in process inventory on May 30 contains $7,540 of direct labor cost.Raw materials consist solely of items that are classified as direct materials.

Work in process inventory on May 30 contains $7,540 of direct labor cost.Raw materials consist solely of items that are classified as direct materials.

The entry to dispose of the underapplied or overapplied manufacturing overhead cost for the month would include a:

Definitions:

Q17: Odonell Corporation estimates that its variable manufacturing

Q19: The change in each of Kendall Corporation's

Q29: Roddey Corporation is a specialty component manufacturer

Q39: Sawyer Manufacturing Corporation uses a predetermined overhead

Q39: Kamp Company uses the weighted-average method in

Q44: A partial listing of costs incurred during

Q71: Narver Corporation uses the weighted-average method in

Q118: Brenneis,Inc. ,manufactures and sells two products: Product

Q135: The following cost data pertain to the

Q146: The contribution margin ratio of Donath Corporation's