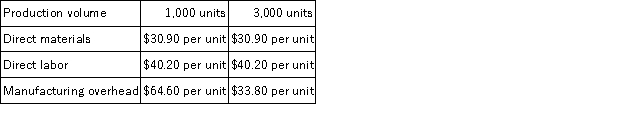

Baker Corporation has provided the following production and average cost data for two levels of monthly production volume.The company produces a single product.  The best estimate of the total variable manufacturing cost per unit is:

The best estimate of the total variable manufacturing cost per unit is:

Definitions:

Direct Labor-Hours

The total hours of work directly contributed by laborers to produce goods or services.

Manufacturing Overhead

The indirect costs involved in making a product, excluding direct materials and direct labor expenses.

Predetermined Overhead Rate

A rate used to apply manufacturing overhead to products or job orders, computed in advance for each period.

Traditional Costing

An accounting method that allocates overhead costs to products based on a single, volume-based cost driver, such as direct labor hours.

Q5: Cuda Manufacturing Corporation uses a standard cost

Q18: Nitrol Corporation manufactures brass vases using a

Q26: The direct labor standards at Hebden Corporation

Q43: The following costs were incurred in April:

Q44: Sulema,Inc.repairs and refinishes antique furniture.Manufacturing overhead at

Q72: In a job-order cost system,direct labor is

Q82: Kosakowski Corporation processes sugar beets in batches.A

Q111: Tullius Corporation has received a request for

Q161: Hewett,Inc. ,manufactures and sells two products: Product

Q177: Rosman,Inc. ,manufactures and sells two products: Product